They are the backbone of the Swiss economy. They offer an array of solutions. They create jobs and play an active role in every industry. They are the SMEs. Pension solutions for Swiss SMEs need to be as diverse and unique as the companies themselves. This is why Tellco offers tailored solutions that meet the real needs of SMEs.

Our many years of experience in providing solutions for SMEs and our relationships with our clients have taught us what SMEs really need: flexible, customised, secure and clear pension fund solutions with a personal touch.

«My company needs an occupational pension scheme that is specifically tailored to our needs»

Your success as a business is built on your business concept: it is what makes you stand out from among your competitors. But that is not the whole story. Your business became successful because you bring expertise, experience, passion and commitment to work with you every day. You stay successful because you refuse to rest on your laurels: you are constantly improving and developing. At Tellco, we understand that you expect your company’s occupational pension solution to work as hard for your business as you do. You should expect no less. That is why we offer specialised pillar 2 pension solutions that meet the particular needs of SMEs. As pension experts, we have many years of experience, streamlined processes and an agile organisational structure. This allows us to offer you modern pension solutions with coherent risk tariffs that are cost-effective in terms of administrative costs. The use of a fair conversion rate reduces redistribution, which helps ensure the long-term viability of the pension fund.

«For my company, pension security is the top priority when it comes to our occupational pension scheme»

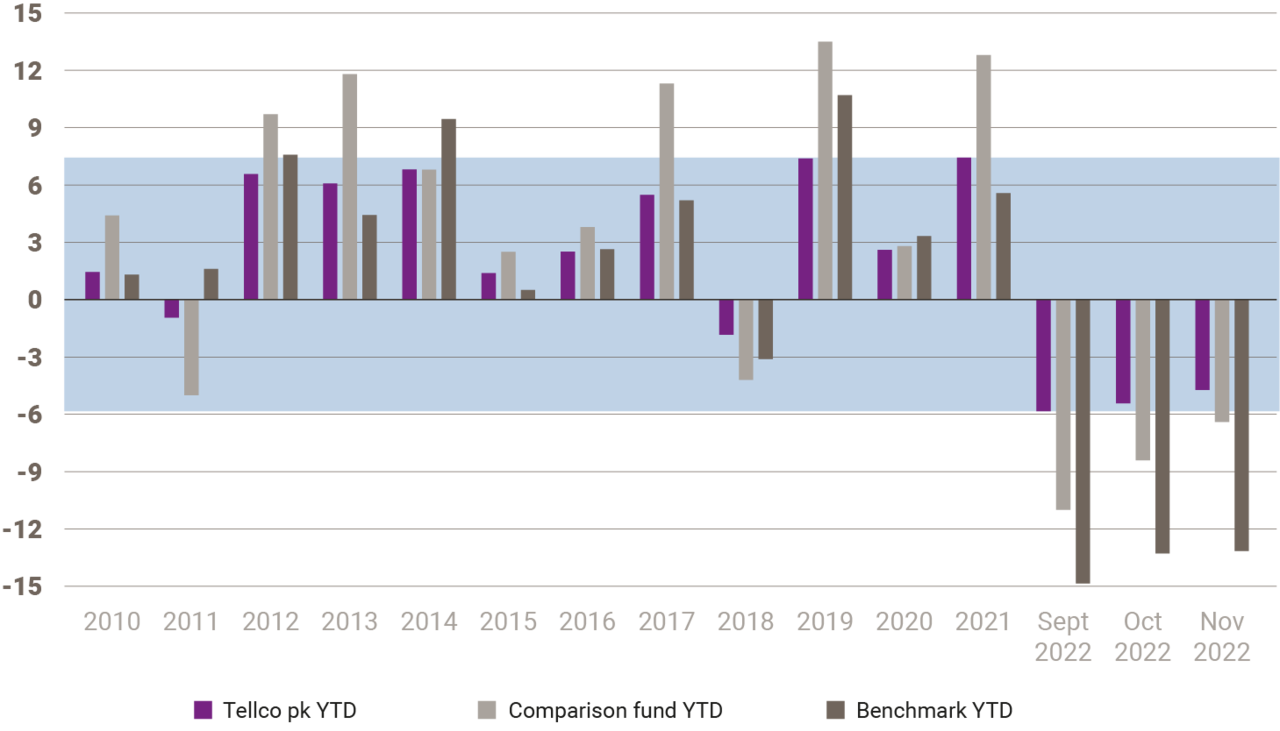

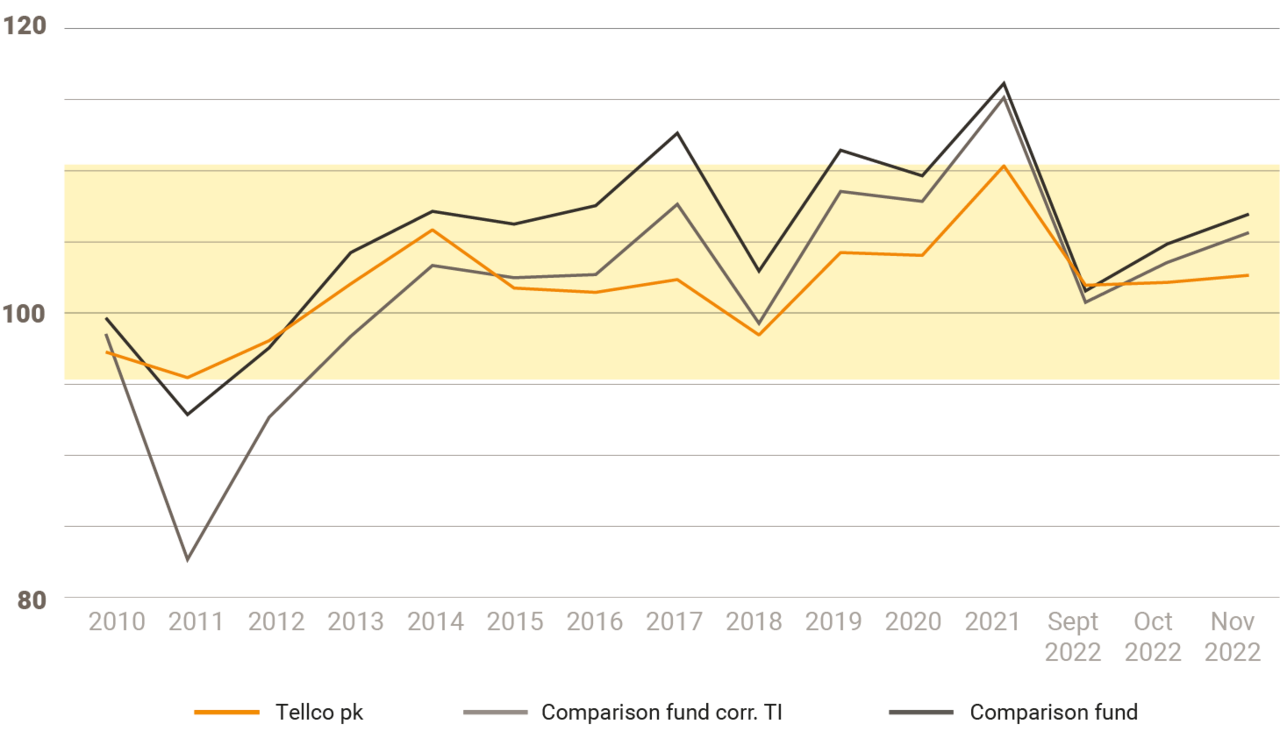

Running a business comes with serious responsibilities. Your employees depend on the success of your business and they want security. At Tellco, we can support you in providing that security: with a pillar 2 pension solution that has pension security at the core. We manage the assets of our affiliated companies with the utmost care. Our specialists always invest your money with a clear focus on security and long-term viability. We prefer to make smaller, less risky profits over a long period of time rather than achieve higher but more risky returns in the short term. Low risk and high security are the defining characteristics of our investment strategy. This is because we see it as our responsibility to secure your capital for today and for the future.

«I expect my pillar 2 pension solution to be flexible»

You probably have to be very flexible in the way you work. The market is dynamic and complex, and customers’ needs are constantly changing. You need to be flexible to adapt. And your occupational pension scheme should be just as flexible as you are. That is why we at Tellco offer pension solutions for your company that you can adjust to your precise needs. We will not force you to commit to a static solution. Instead, this is our promise to you: you can customise your Tellco pension fund solution with add-ons as and when you need them, and the solution can grow flexibly alongside your business.

«I want to know the people behind my company’s occupational pension scheme»

Your employees choose to work for you because you have the specialist skills and personal qualities that they value. You select your employees and business partners with great care. You take the time to make sure that everyone who works with you is a good fit for you and your company. That is the only way to build trust. You take the exact same approach to your occupational pension scheme. Getting to know each other is as important to us as it is to you. That is why we operate from several locations throughout Switzerland. One of our regional representatives based near you will be glad to visit you in person and work out your ideal pension fund solution with you. That way, you can rest assured that whenever you have a question or a request, you have a designated contact person who knows you. Furthermore, we will offer you a solution that is tailored to your business sector, complete with a custom tariff, as a matter of course.

«I want to understand all the ins and outs of my employees’ pillar 2 coverage»

Your own business activities will probably have taught you this rule: the more complex a thing is, the more difficult it is to talk about it in a way that is easy to understand. In other words, it is often more difficult to explain things in simple terms than it is to explain them with jargon that not everyone understands. But making sure that you are understood correctly is an essential part of building trust. This applies to your relationships with your employees just as much as it applies to your relationships with clients and business partners. We at Tellco also strive for clarity in all that we do: clear communication and clear models and strategies. You should always be completely clear about what your pension solution with us looks like. You should expect no less than complete transparency from us. With Tellco, there are no hidden costs and no hidden small print that will burden you with unwanted obligations or disadvantages. And if there is ever anything you are not sure about, or anything you want to know more about, we are here for you at any time.